Is honesty really the best policy in relationships? Or is it just one of the many policies for us to choose from?

In some cases, telling a little white lie can be a harmless way of softening a blow, working around poor timing, or delivering unsavory feedback in a gentler way. When it comes to fudging the facts about finances, though, the repercussions on a relationship can be severe if those lies begin to unravel.

We surveyed over 1,000 Americans who were either in a relationship, engaged, married, divorced, or widowed to find out whether the looming threat of emotional turmoil was enough to stop people from concealing certain purchases from their significant others. Spoiler alert: It wasn't.

Read on to find out how couples across generations are tackling their financial management, which purchases are swept under the rug most frequently, and who starts snooping when curiosity gets the best of them.

How Do They Manage?

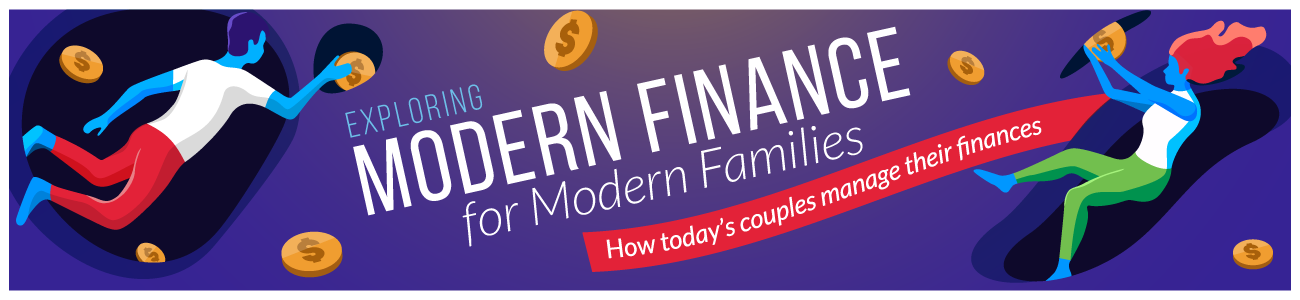

Joint accounts are a great way for couples to keep financial matters convenient, transparent, and easy to manage. On the flip side, though, they can pose an issue for partners who don't bring equal wealth to the table and can cause an even bigger problem in the event of a breakup. That's probably why just 16 percent of coupled-off or engaged respondents relied on a shared bank account to manage their finances, compared to 59 percent of married folks. Unmarried couples were much more likely to maintain separate accounts and either split their bills in half or pay them proportionally to their respective incomes.

Generationally, baby boomers were the most likely to manage their money using a shared account at 58 percent (though, as the oldest generation we surveyed, they were probably the most likely to be married as well), followed closely by Gen Xers at 52 percent. Just 38 percent of millennials used shared accounts.

Even in holy matrimony, our survey's youngest demographic tended toward maintaining separate accounts, no matter their cultural background. This generational shift is mirrored closely by other millennial-specific trends, such as marrying later, which is tied to a higher frequency of living together before marriage and being more established in their careers when they finally tie the knot.

When to Combine?

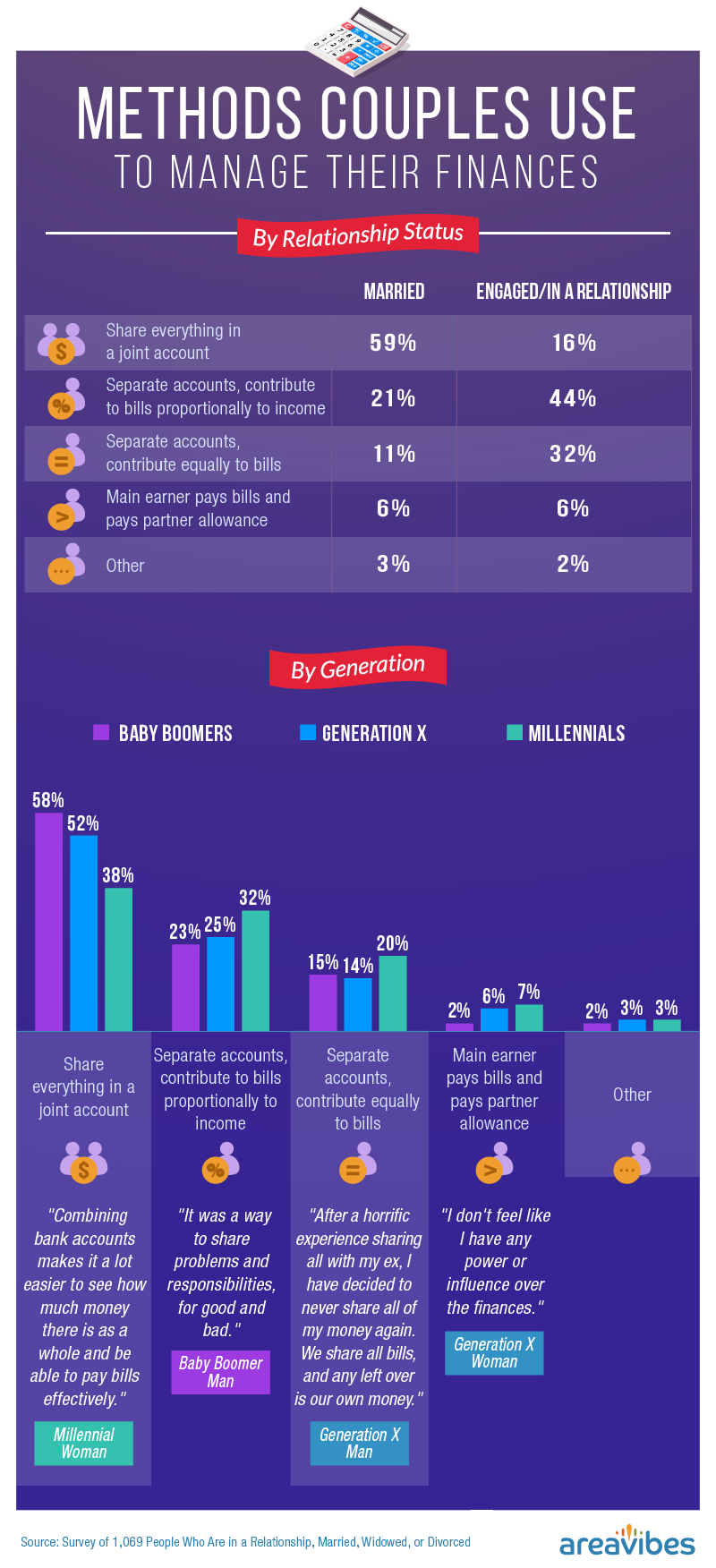

In relationships, money issues can easily sink ships – so it's important to adopt healthy personal finance habits when you move in with your partner. This was the moment when the largest chunk of our respondents (39 percent) began managing their finances as a team, followed by getting married (24 percent). Just 17 percent of couples said they had been jointly managing their money since the beginning of their relationship.

No matter when our respondents decided to combine their finances, the three most common money management structures yielded extremely high satisfaction rates: Complete commingling left 97 percent of respondents feeling good about their decision; proportional bill payment was 95 percent satisfactory; and an even split was considered a great choice by 94 percent of adopters.

The outlier was a setup in which the higher earner pays the bills while giving their partner an allowance. While a still-impressive 78 percent of people were satisfied with this method, it's important to understand where the other 22 percent are coming from: A lack of financial independence can create a troubling situation for the dependent partner, including inequality, a loss of identity, and an overarching sense of dominance.

In fact, in the most insidious of circumstances, cutting one's partner off from earning their own income or limiting the amount of money available to them is considered to be a form of domestic violence called financial abuse.

Who Hid What?

Nobody enjoys addressing the fact that they're using a different notch on their belt or filling out a larger pant size than usual, but a recent Acorns study revealed that 68 percent of people would rather discuss their weight than the amount they have in their savings account. Disclosing certain info about one's financial situation can be touchy – if not downright uncomfortable – so it's no wonder so many of our respondents felt they had something to hide.

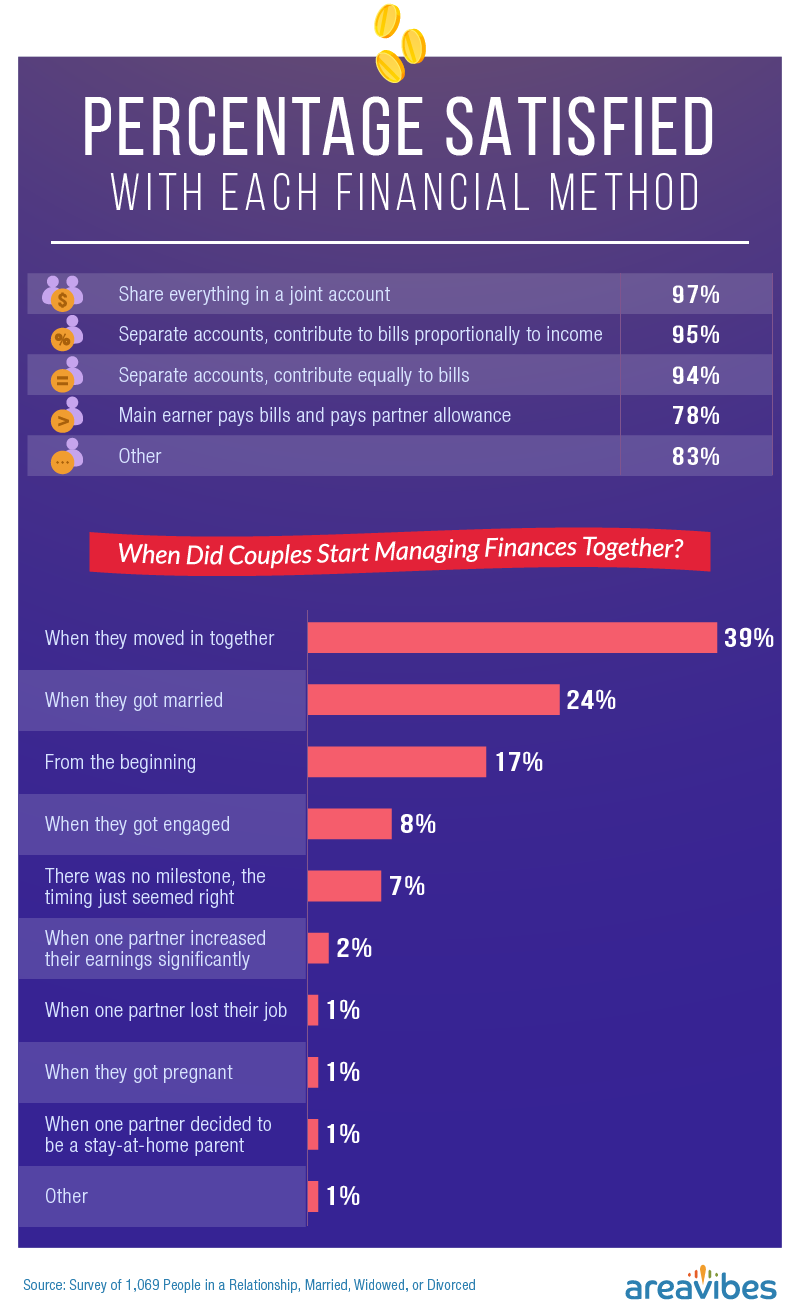

Proportionately speaking, women were more likely to conceal purchases in the categories of fashion and beauty, while men went undercover about their alcohol, drug, and video game purchases. Both demographics frequently kept fast food expenditures from their partners as well.

On the whole, though, men and women reported very different vices, even when it came to less common categories. For example, 12 percent of male respondents had hidden a porn-related purchase, compared to just 2 percent of females. On the other hand, 15 percent of women reported concealing grocery spending, compared to 7 percent of men.

The average amount for a strategically omitted junk food purchase was just $15, but the numbers only escalated from there. Clandestine electronics purchases racked up the highest bills, averaging a whopping $371 per transaction – unsurprising in a world where, even though they've been around for decades, gadgets like computers are getting more expensive.

Why So Secretive?

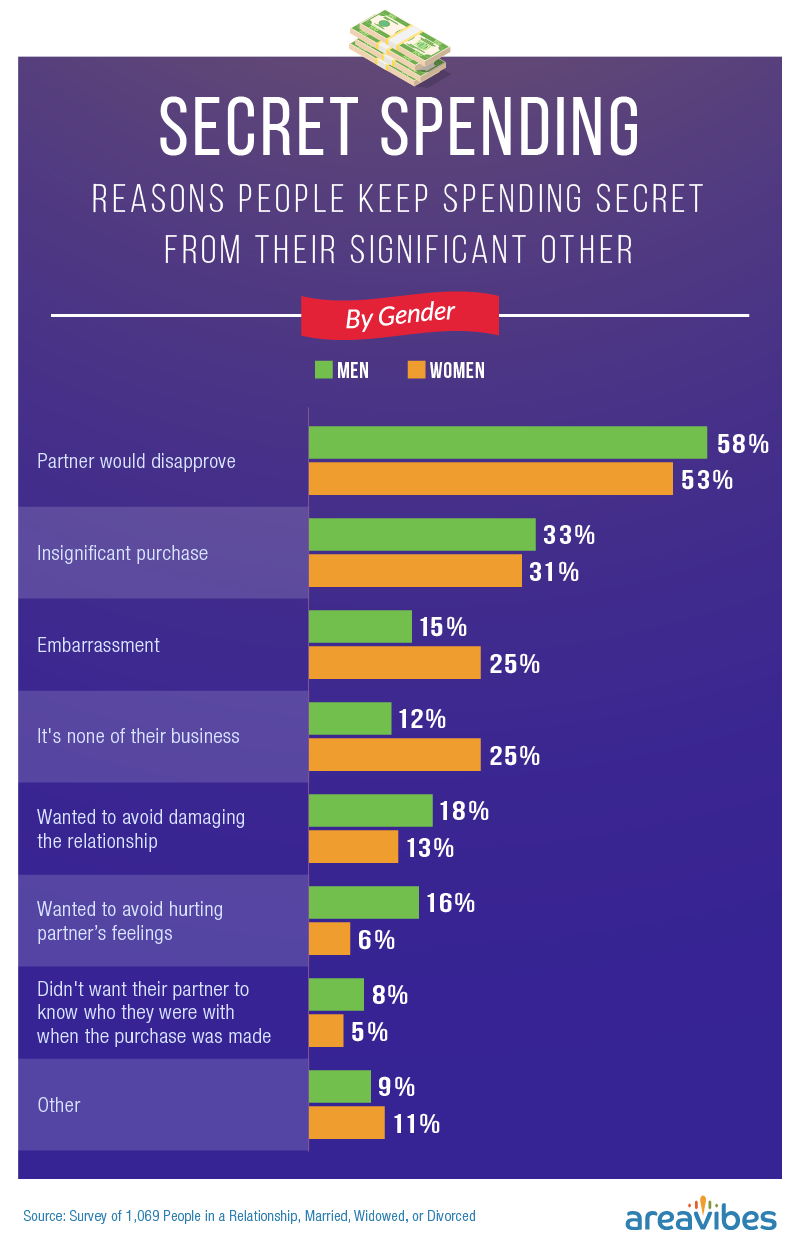

The leading rationale behind our respondents' hidden spending was a fear of their partner's disapproval, with 58 percent of men and 53 percent of women naming this specific worry as the root of their secrecy. The fact that their purchase was largely insignificant was a distant second but yielded similar figures between the sexes (33 percent of men and 31 percent of women). On the whole, women more frequently expressed feelings of shame and a need for privacy, while men reported not wanting to damage their relationship or hurt their partner's feelings.

While adding yet another pair of shoes to your dozens-strong collection might produce a twinge of understandable guilt, chronically feeling bad about spending money can be more problematic than prudent. If you find yourself overtaken by spending guilt when you simply don't deserve it, proper financial planning and budgeting can be a great first step toward an increased sense of freedom and responsibility.

Whose Policy Is Honesty?

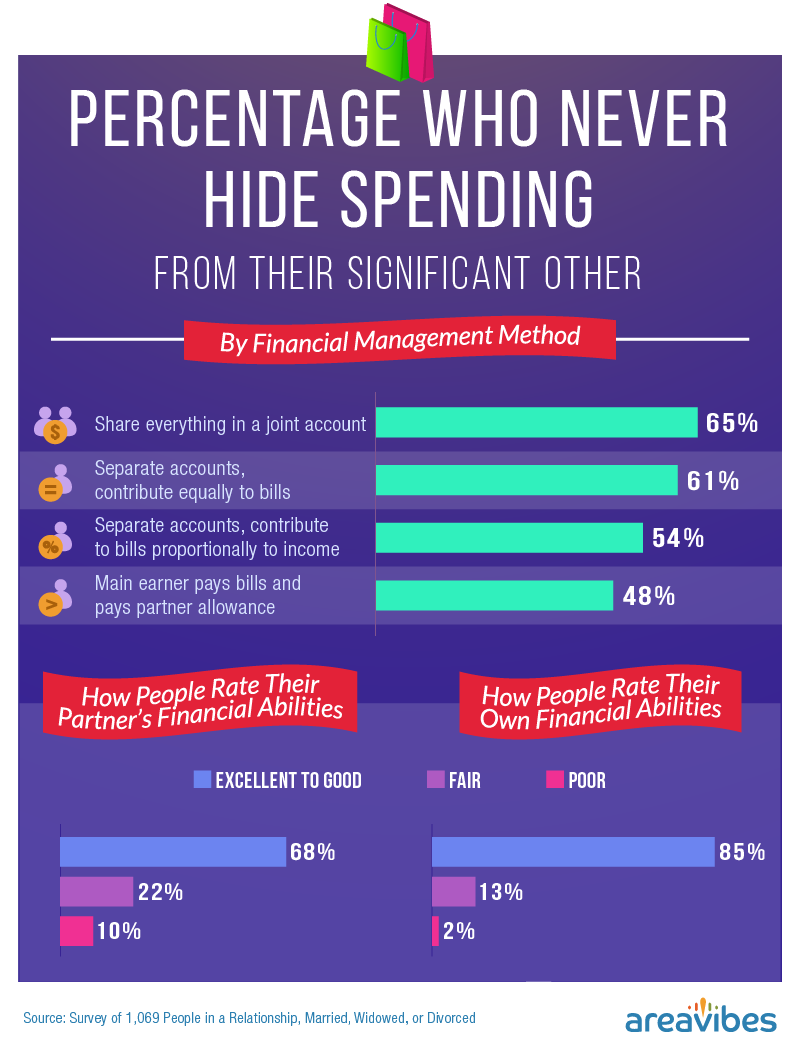

There are, of course, people out there who have never felt the need to hide spending from their partner. Sixty-five percent of respondents with fully combined financials said they've never concealed a purchase from their partner (though in this case, secrecy would certainly be harder to achieve given the transparency inherent to a commingled account).

Another 61 percent of respondents using the raw contribution method and 54 percent using the proportional method had never hidden their spending. Once again, allowance-based couples reported the lowest rate of overall openness at 48 percent.

When it came to our respondents' overall impressions of their financial abilities versus their partners', people were much more forgiving with themselves. Eighty-five percent said their own financial abilities were good to excellent, compared to just 68 percent who viewed their partner that way. On the flip side, only 13 percent of respondents said they were fair at dealing with money, while 22 percent said their partner fell into this category.

Of course, we can't exactly know whether our respondents were judging their significant others more harshly than themselves. If it's time for a little self-reflection, here is a handy list of questions to determine whether you are the type to ask a little too much of your partner sometimes.

Who's Been Snooping?

While it certainly depends on who you ask, the general consensus about snooping through someone's phone or computer is that the practice is not OK. Instead of giving in to temptation, relationship experts recommended communicating any trust-related concerns you may have with your spouse or significant other in an honest, straightforward manner.

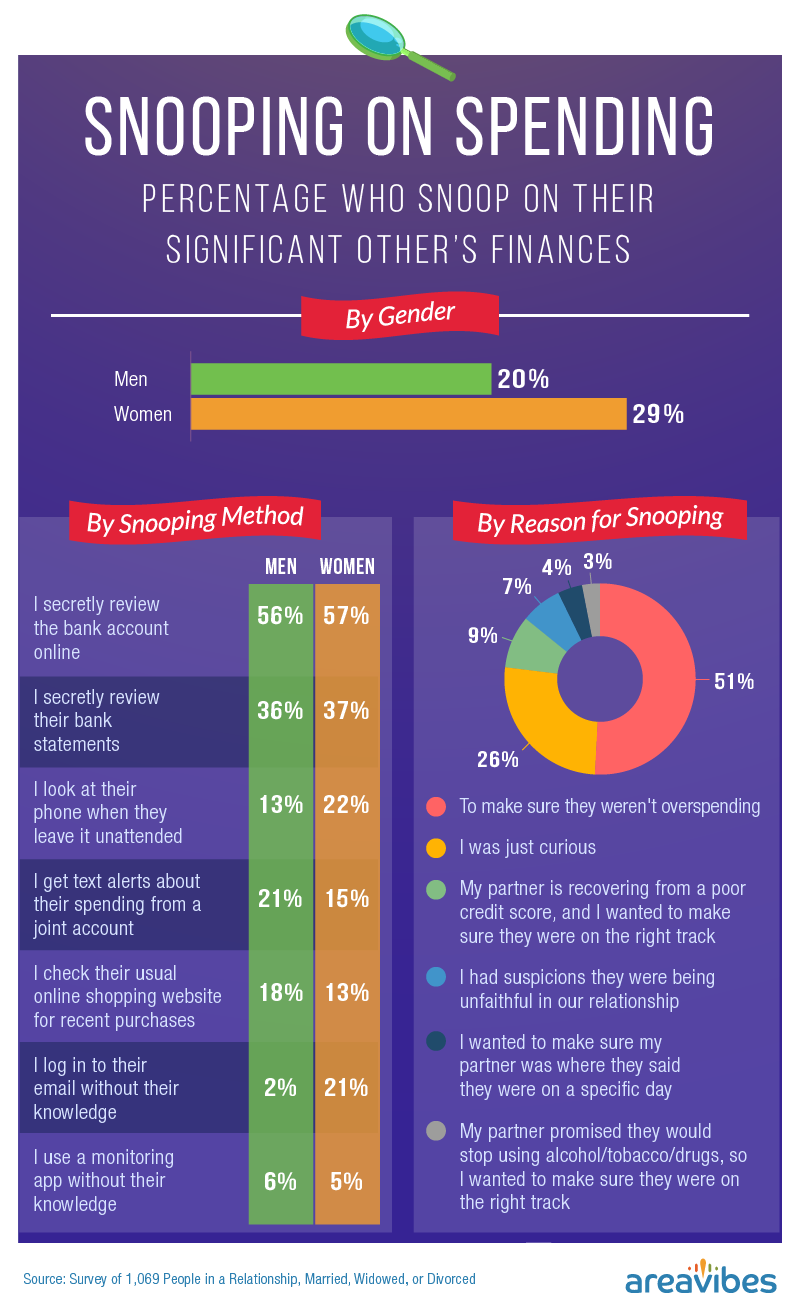

However, as wholesome as that advice may be, 29 percent of women and 20 percent of men admitted they had snooped on their partner's finances in the past. The most popular practice for both genders was secretly checking online bank accounts, followed by checking up on bank statements. However, men were more likely to receive text alerts about their partner's spending from their joint account or snooping around for recent online purchases, while women preferred rifling through an unattended phone or secretly logging into their partner's email account.

Budgeting as a couple is a challenge that often takes a lot of effort and elbow grease, so it's no wonder that 51 percent of snoopers were on the hunt for signs of overspending. Sheer curiosity was a distant second at 26 percent.

Who's Coming to Blows?

The topic of finances is one of the most common arguments (if not the most common) for couples to have, especially if one half of the couple is a stay-at-home parent or if one partner is more spendy while the other prioritizes saving. Among our respondents, certain generations experienced a greater sense of harmony than others when it came to spending squabbles.

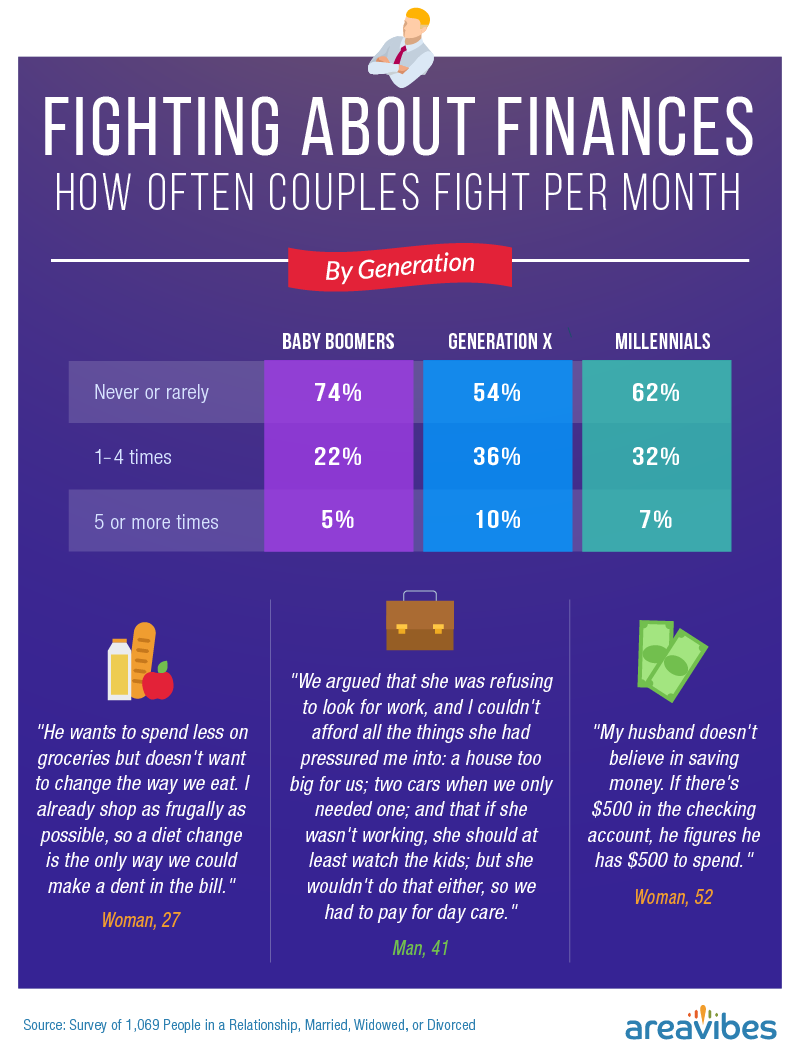

Baby boomers were the most peaceful overall. This generation had the highest percentage of respondents who fought never or rarely in regard to money matters (74 percent) and the lowest number of very frequent fighters (5 percent). Millennials came in second overall, leaving Gen Xers to account for the bulk of the arguing: Thirty-six percent of respondents in this generation said they argued 1 to 4 times per month and just over half said they rarely or never fought about finances. Another 10 percent experienced 5 or more money arguments per month – that's twice as many compared to baby boomers.

Finance-focused fights can take on a number of forms, none of which is without a possible resolution. The common thread: communicate, communicate, communicate.

Money is Complicated, But Spending It Wisely Doesn't Have to Be

Combining finances is a decision that's not to be taken lightly. Joint accounts were most popular among married people, while unmarried couples divvied up their financial responsibilities either equally or proportional to their pay.

When it came to secret spending, women were more prone to concealing fashion and beauty purchases, while men often hid away their video game and booze receipts. The main reason: worry that their partner would disapprove of their purchases. When curiosity got the best of our respondents, snooping was the answer for one-fifth of men and about one-third of women, with clandestine bank account checkups being the most popular choice.

Methodology and Limitations

To collect the data you see in this project, we surveyed 1,069 people in the United States who were in a relationship, engaged, married, divorced, or widowed. People who were single were excluded from the results. Forty-eight percent of our respondents were men, and 52 percent were women. Ages ranged from 19 to 83 with a median age of 35. Forty-five percent of respondents were married, 24 percent were in a relationship, 22 percent were single, 2 percent were engaged, and the remaining 6 percent were divorced, separated, or widowed.

We used attention-check questions to help verify that respondents were answering questions as accurately as possible; participants were excluded if it was clear they were not paying attention. There are known issues with self-reported data, such as exaggeration, telescoping, selective memory, and more. Hypotheses were based on means alone so we recommend further research be done to gain deeper insights on this topic.

Fair Use Statement

Do you find this article on relationship finances interesting? Don't keep it a secret! Feel free to share any insights from this page for noncommercial purposes. We only ask that you link back to this page when doing so.